Pesky payroll pitfalls. More than an alliteration, when it comes to managing your leaves of absence, payroll inconsistencies and miscommunications can have very real ramifications to both your employees and your organization’s bottom line.

Calling the intricate connection between payroll and a leave of absence “complicated” undersells the reality quite a bit. Shifting laws, state programs, start and stop dates, and pay rates all play a factor in how much your people should be getting paid, and if you’re reading this there’s a good chance you’re at your wits end trying to keep track of all of this manually.

We certainly know payroll is looking for a better way too. With how complicated it is for employees to accurately navigate state benefits programs on their own, it’s far too common for employers to pay employees more than they’re owed during a leave of absence. If an employee is getting paid from a short-term disability provider, for example, the amount they’re owed is reduced by however much the state is providing them as part of their benefits program.

Even if your employee lives in a state without a benefits program, overpayments can be a significant problem if information isn’t accurate and updated in real-time.

Tilt automates pay adjustments

Has a leave date changed? Has the employee’s salary changed while on leave? Does your employee have a side-gig that you aren’t factoring in that they report to the state as income? Are you operating from the most up-to-date pay percentages for the given state or city your employee resides?

These common occurrences spell “payroll danger” (not literally) and can cause significant inaccuracies in your pay calculations if done manually.

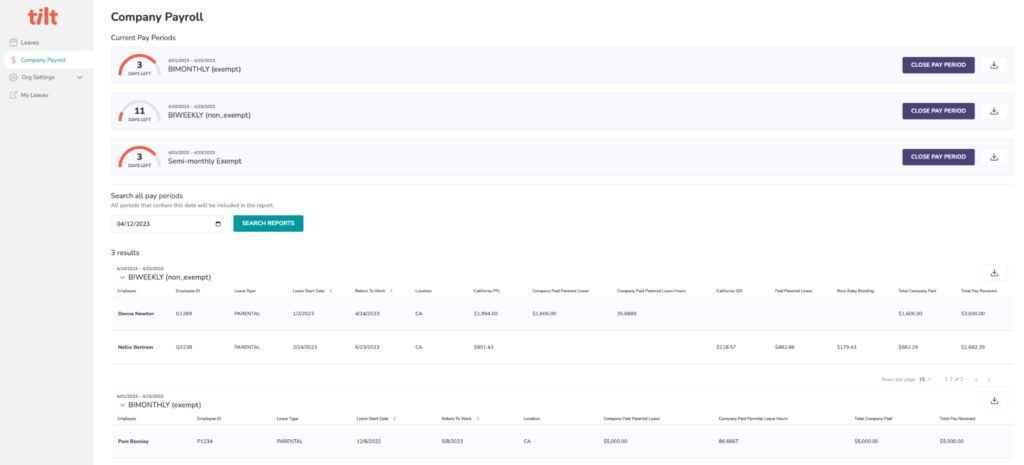

Tilt takes the guesswork out of it by automating pay adjustments right within our platform. When payroll accesses Tilt, they’ll know that the pay calculation numbers have been updated to reflect any outside income that may affect state benefit amounts, changes in leave start and stop dates, salary fluctuations and has up-to-date state benefits information baked into the platform.

Tilt factors in provider benefits for you

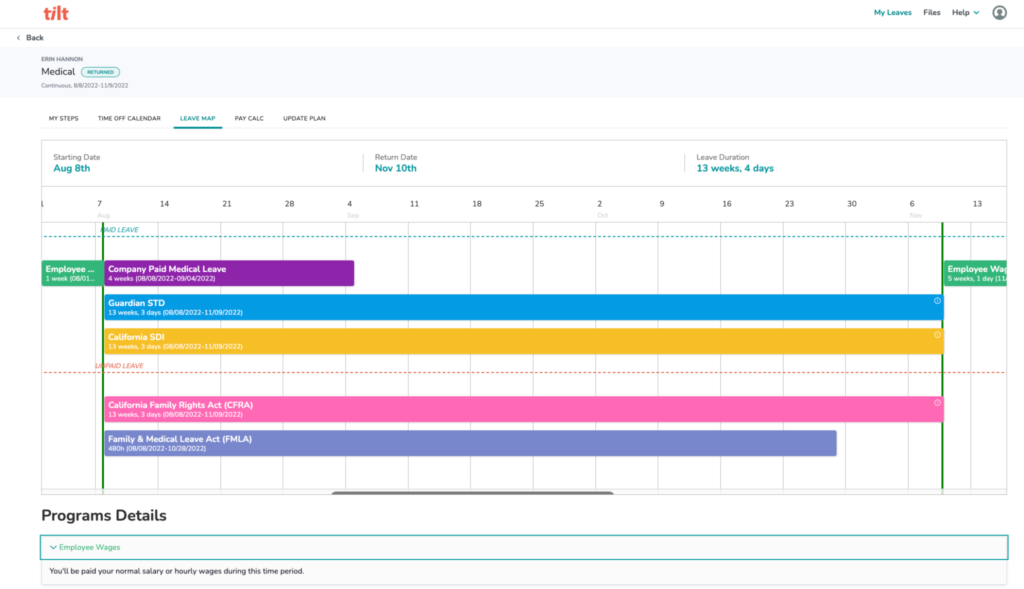

If your organization offers employees Short-Term Disability (STD), for example, and they live in a state that offers State Disability programs, the two fund sources are dependent on each other. The amount that needs to be paid by the STD provider is reduced by the amount the state provides.

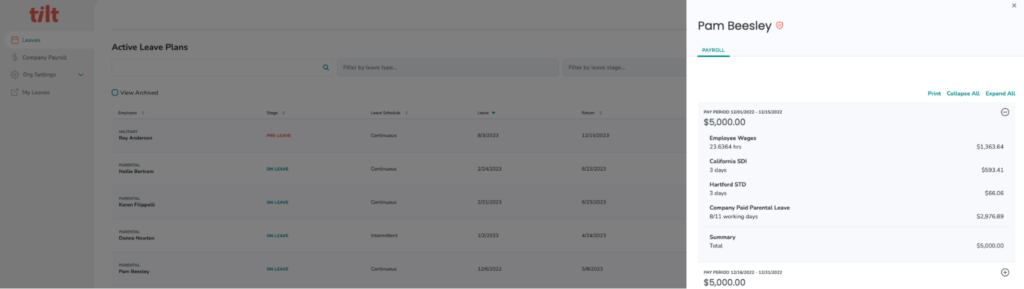

Manually keeping track of this requires documentation and communication with the state, your employee, your STD provider and payroll. Since benefits have a start and stop date, any changes to a leave duration will need to be adjusted accordingly. Tilt makes it easy for People Operations, payroll and employees to see exactly how much they are getting paid and where the money is coming from. We even break the leaves down by employee type.

Tilt’s proactive approach to payroll

With our personalized leave maps, your employees won’t have any confusion either. By visually demonstrating exactly where their money is coming from and for how long we take payroll questions off your plate before they’d even be put on your plate. If there are questions about payroll, their Leave Success Manager (LSM) is backed by our in-house payroll team to field any questions on your behalf.

Tilt helps you prevent overpayments before they happen. We make it simple to see exactly where and how much your people are getting paid.

How Tilt makes applying for state benefits a breeze

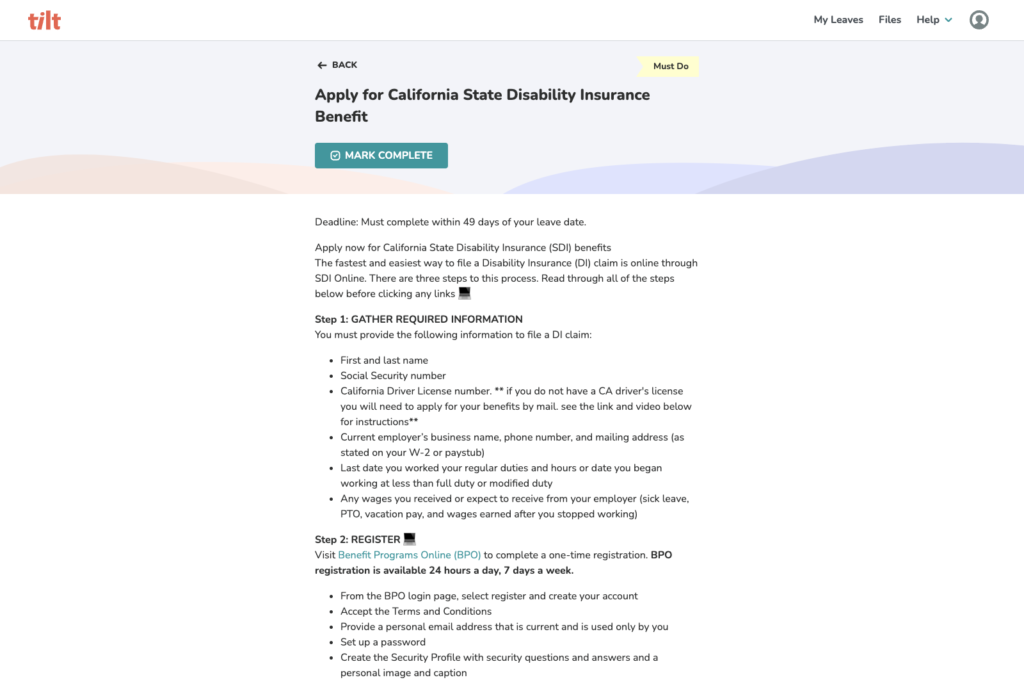

Another factor in getting LOA payroll right is ensuring your employees are able to efficiently apply for state benefits at scale. If there is a delay or an error in the form filing process that could have serious implications to your employees being made whole. Tilt walks your employees through the process step-by-step and we even send out reminders for important filing dates so you won’t be bothered.

At Tilt we understand the legal implications associated with filing on behalf of your employees, and also know that relying on a 3rd party for something so important is a risk you can’t afford. That’s why we make it easy for your people to apply by providing everything they need to know, and our LSMs are there to guide them through the process if they have any questions.

It should be noted that another byproduct of overpaying your employees is that a state may reject a claim if it thinks the employee is getting more money than is allowed to qualify for benefits.

Avoid those pesky (and costly) pitfalls with Tilt, and put yourself at ease knowing the leave management experts have your payroll needs taken care of.

About Tilt

Tilt is leading the charge in all things leave of absence management through easy-to-use tech and human touch. Since 2017, our proprietary platform and Empathy Warriors have been helping customers make leave not suck by eliminating administrative burdens, keeping companies compliant, and providing a truly positive and supportive leave of absence experience for their people.