As paid leave laws continue to evolve with little federal standardization, employers are once again navigating a complex and expanding patchwork of state and local requirements. In 2026, meaningful developments are concentrated at the state level, from new paid family and medical leave programs going live, to expanded eligibility, benefit changes, and new notice and job-protection obligations.

This report brings together the most important federal, state PFML, and leave-adjacent updates HR teams need to know right now. Our leave law experts closely track these changes to help you anticipate compliance obligations, understand operational impact, and support employees consistently across jurisdictions. Whether you manage leave in one state or many, this report is designed to serve as a clear, practical resource for staying informed and prepared in the year ahead.

Federal Updates

No National Paid Family & Medical Leave (PFML) Program On the Horizon

There was no meaningful movement toward a national Paid Family and Medical Leave (PFML) program in 2025, and a national PFML program remains unlikely in 2026. For HR teams, this means the same reality continues: paid leave is still primarily driven by state laws and employer policies, not federal requirements. Employers with employees in multiple states should continue planning for a growing patchwork of state PFML rules rather than a single national standard.

Bipartisan Interest in Advancing State PFML Programs

In 2025, Congress showed renewed bipartisan interest in paid family and medical leave through proposals focused on supporting and coordinating state programs, rather than creating a national mandate.

Two related bills were introduced:

- The Interstate Paid Leave Action Network Act (I-PLAN) would create a voluntary interstate network for states to share best practices and explore ways to better align their paid leave programs.

- The More Paid Leave for More Americans Act would establish a federal grant program encouraging states to launch or expand PFML programs, including through public-private partnerships.

As of January 1, 2026, both proposals remain active but dormant, having been introduced but not advanced out of committee. These bills reflect growing recognition in Congress that state PFML laws are complex and difficult to administer, especially for multi-state employers. However, at least for now, the federal approach remains focused on supporting state experimentation rather than standardizing leave at the national level.

State PFML Programs

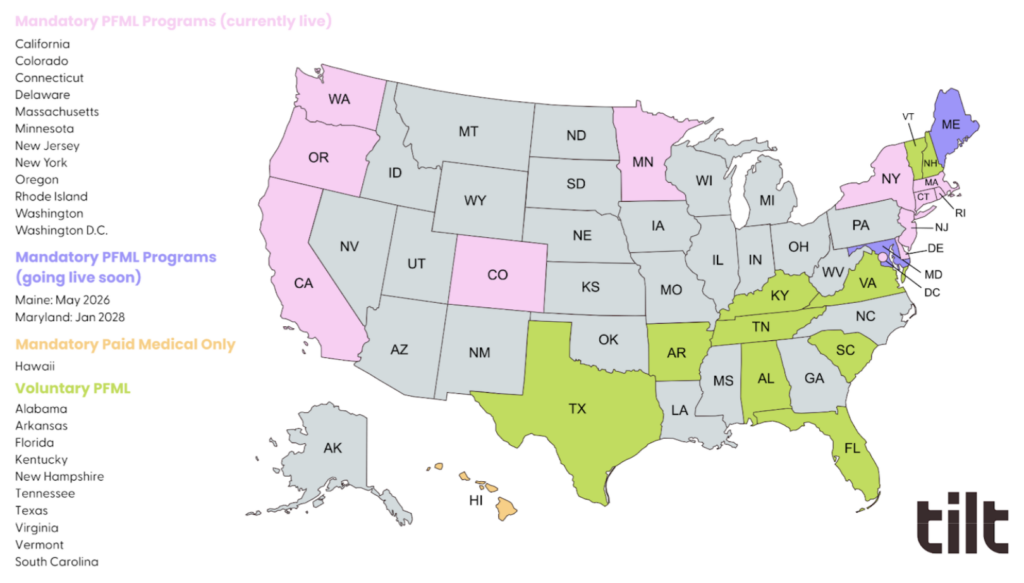

The most meaningful paid family and medical leave developments in 2026 continue to occur at the state level, where programs generally take one of two approaches: mandatory or voluntary.

Mandatory programs generally operate as “social insurance,” funded through payroll deductions, with paid benefits provided to eligible employees for qualifying reasons. In contrast, voluntary programs generally allow—but do not require—employers (and sometimes employees) to obtain PFML coverage, often by purchasing insurance through the private market.

The map below highlights states that have passed mandatory and voluntary PFML laws.

Voluntary state PFML programs generally see low participation rates and have had a limited impact on overall access to paid leave, so this update focuses on the more impactful mandatory programs.

Mandatory program updates:

As shown above, 13 states and Washington, D.C. have enacted mandatory PFML laws. Minnesota and Delaware’s programs began paying benefits as of January 1, 2026, bringing the total to eleven states (plus D.C.) actively providing benefits to eligible employees. Maine’s PFML will provide benefits later this year, and Maryland’s benefit start date was pushed out to January 2028.

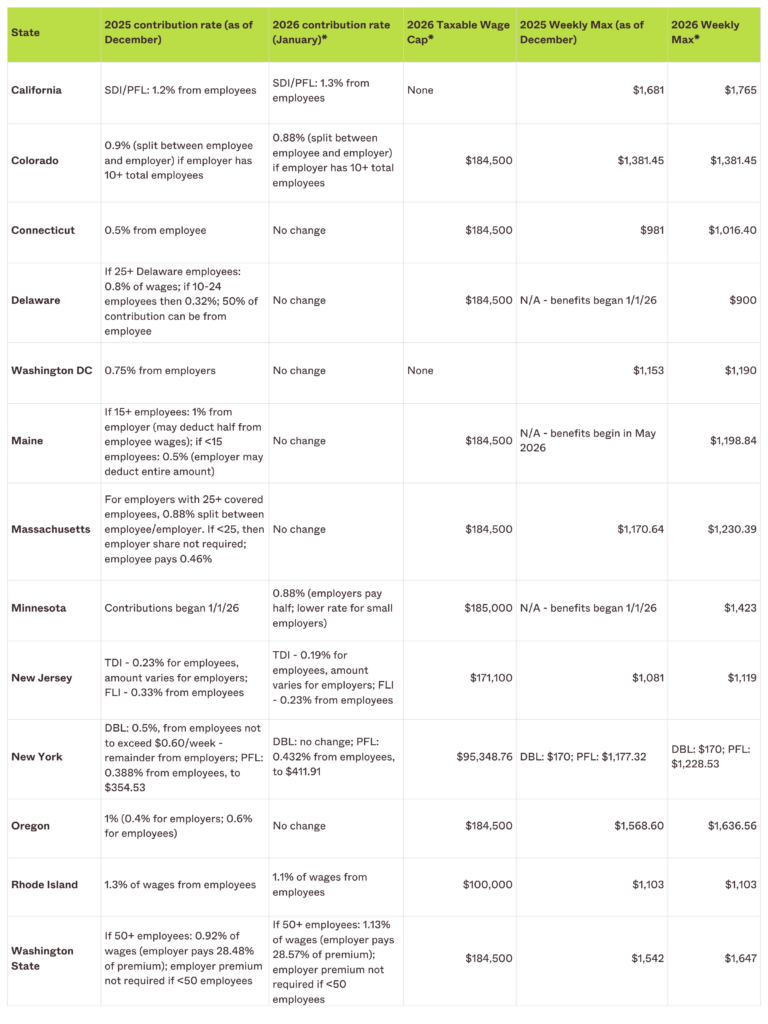

In January 2026, many of these programs updated employer and/or employee contribution rates, taxable wage caps and weekly benefit maximums:

Potential PFML developments for 2026

It’s still too early to know whether any states will successfully enact new paid family and medical leave (PFML) programs in 2026. Even if legislation passes, we would not expect benefits to become payable until at least 2028 or 2029, given the time required to stand up agencies, collect contributions, and issue implementing regulations.

Even so, a few states appear better positioned than others to pass mandatory PFML legislation in 2026:

Virginia

Virginia is currently a voluntary PFML state, but the legislature passed mandatory PFML legislation in both of the last two sessions, only to see it vetoed by Republican Governor Glenn Youngkin. With Democrat Abigail Spanberger elected governor and Democrats controlling the state legislature, the political conditions suggest Virginia may finally make the shift to a mandatory program.

New Mexico

New Mexico has come close to passing a mandatory PFML program in each of the past two years, with bills advancing deep into the legislative process but falling just short of passage. Given that history, and continued interest from Democratic leadership, it is likely the legislature will take another run at PFML during February’s 2026 session.

Hawaii

Hawaii already requires employers to provide Temporary Disability Insurance (TDI), giving the state an existing wage-replacement infrastructure for an employee’s own medical conditions. Paid family leave proposals have been introduced in prior sessions, and PFML could be framed as a natural extension of the state’s current system rather than a ground-up program.

Illinois

Illinois has enacted a steady stream of employee-friendly labor and employment laws in recent years, including mandatory paid time off (PTO) and scheduling protections. While PFML has not yet crossed the finish line, the state’s broader policy direction and strong labor support keep it on the short list for renewed consideration.

We’d also put Vermont, Michigan and Nevada on the watch list for potential PFML developments, but the likelihood is currently less in those states.

State Leave Law Updates

Operational note for Tilt customers: Many states require employee leave notices at different points in time (for example, at hire, annually, and/or when leave is requested). For Tilt-managed leaves, Tilt automatically generates and sends the required leave-triggered notices when a leave request is submitted. Employers remain responsible for other required notices, such as workplace posters and general at-hire or annual notices.

California

Paid Family Leave Expanded to Designated Persons (2028)

Starting July 1, 2028, California’s Paid Family Leave (PFL) program will provide wage-replacement benefits to eligible employees caring for a seriously ill “designated person”—someone related by blood or whose relationship is equivalent to family. The change aligns PFL with the California Family Rights Act (CFRA), which already allows unpaid, job-protected leave for such relationships.

Violence Victim Leave Notice

On July 1, 2025, California’s Civil Rights Department (CRD) issued a required notice of employee rights under the Survivors of Violence and Family Members Leave Act (AB 2499). Employers must provide this notice at hire, annually, upon request and when the employer has notice of a qualifying event. For more information about the law and its protections, you can review the CRD’s FAQ document.

Colorado

New NICU Leave

As of January 1, 2026, Colorado’s paid leave program (FAMLI) includes up to 12 additional weeks of leave for eligible parents whose newborn is receiving inpatient care in a neonatal intensive care unit (NICU). This new benefit stacks on top of the standard 12 weeks already available under FAMLI, so in some cases a new parent with a newborn in the ICU could qualify for up to 24 weeks of FAMLI leave (or up to 28 weeks if pregnancy-related complications apply). Employers should consider how NICU leave will interplay with existing leave policies (such as paid parental bonding leave) and clarify those policies as needed.

Connecticut

Expanded Accommodation and Leave Protections

Effective October 1, 2025, Connecticut expanded its employment discrimination laws enforced by the Connecticut Commission on Human Rights and Opportunities (CHRO) to protect employees based on their status as victims of sexual assault or human trafficking. Employers may not discriminate on this basis and must provide reasonable accommodations, including a reasonable leave of absence, when needed. Covered reasons include medical or psychological care, safety planning or relocation, obtaining services from advocacy organizations, and participating in legal proceedings related to the incident, including when assisting a child who is a victim.

Paid Sick Time Requirements Expand (Leave-Adjacent)

Connecticut’s Paid Sick Leave Law continues to expand its reach. As of January 1, 2026, the law applies to employers with 11 or more employees in Connecticut, down from the 25-employee threshold in 2025. Employers must provide one hour of paid sick time for every 30 hours worked, up to 40 hours per year, and are required to provide a written notice of paid sick leave rights to Connecticut employees.

Delaware

Paid Family and Medical Leave Program Goes Live

As of January 1, 2026, Delaware’s Paid Family and Medical Leave (PFML) program began paying benefits, providing up to 12 weeks of paid parental leave and up to 6 weeks of paid medical leave, family caregiving leave, or qualifying military exigency leave, subject to an overall 12-week cap per application year. Eligible employees must have worked in Delaware for at least 12 months and 1,250 hours in the prior year, and benefits are paid at 80% of average weekly wages, capped at $900 per week.

To receive paid benefits, employees must work for a covered employer, as determined by Delaware employee headcount thresholds. Employers with 10–24 Delaware employees are required to provide parental leave only, while employers with 25 or more Delaware employees must provide coverage for all qualifying reasons. Employers with fewer than 10 Delaware employees are not obligated to participate.

Covered employers must post and distribute the Delaware PFML Notice of Employee Rights issued by the Delaware Department of Labor. The notice must be displayed in a conspicuous workplace location and provided to employees at hire, upon request for leave, and when an employer becomes aware of an employee’s potential need for PFML.

Notably, employees who welcomed a new child in 2025 may qualify for paid DE PFML bonding leave in 2026, if they’re within one year of the child’s birth or placement, regardless of whether they already exhausted FMLA and employer-provided leave available to them.

Illinois

Paid Military Funeral Honors Detail Leave

As of August 1, 2025, Illinois employers with 51 or more employees must provide up to 40 hours of paid leave each year, capped at 8 hours per month, for employees serving on a military funeral honors detail. Leave is paid at the employee’s regular rate and is separate from other paid time off. To qualify, employees must have worked for at least 12 months, logged 1,250 hours in the past year, and have the necessary military or authorized provider training. Employers may only deny leave in narrow situations, such as certain 24/7 care settings, and employees have reinstatement rights when leave ends.

Expansion of Employee Blood and Organ Donation Leave Act

Effective January 1, 2026, Illinois expanded eligibility under the Employee Blood and Organ Donation Leave Act to include part-time employees. Both full-time and part-time employees may now take up to 10 days of paid leave per year to serve as an organ donor, and up to 5 days for bone marrow donation.

New NICU Leave Law

Beginning June 1, 2026, Illinois employers with 16 or more employees must provide unpaid, job-protected leave to employees with a child in a neonatal intensive care unit (NICU). Employers with 16–50 employees must provide up to 10 days, and those with 51 or more up to 20 days. Leave may be taken continuously or intermittently (in at least two-hour increments). For FMLA-eligible employees, this NICU leave generally applies after FMLA entitlement has been exhausted.

Paid Breaks for Nursing Employees (Leave-Adjacent)

Effective January 1, 2026, amendments to Illinois’s Nursing Mothers in the Workplace Act require employers to provide paid break time for employees to express breast milk for up to one year after childbirth. Employers may not reduce pay or require use of accrued leave, and breaks must be paid unless doing so would create an undue hardship under the Illinois Human Rights Act (IHRA).

Indiana

School Meeting Leave

Effective July 1, 2025, Indiana requires employers to provide unpaid leave for employees to attend certain school-related meetings for their children, such as conferences addressing truancy or meetings related to an Individualized Education Program (IEP).

Iowa

Leave for Adoptive Parents

As of July 1, 2025, Iowa requires employers to provide the same leave and benefits to employees adopting a child up to age six as they offer to biological parents, for the first year of the adoption. Employers with employees in Iowa should review their parental leave policies to ensure they reflect compliance.

Massachusetts

New PFML Posters, Notices and Rate Sheets

The Massachusetts DFML released its 2026 PFML posters, notices, and rate sheets, and employers were required to distribute updated contribution‑rate notices to current MA employees by December 1, 2025. New hires must receive the updated PFML notice within 30 days. Updated materials are available on the DFML website.

Maine

PFML Program to Launch in May 2026 (or later)

Maine’s Paid Family and Medical Leave (PFML) program is scheduled to begin paying benefits on May 1, 2026, but covered employers have had compliance obligations in place since January 2025. Employers with any employees in Maine need to ensure they’ve posted the required PFML workplace notice, registered in the state PFML portal to report wages and remit premiums, and ensured payroll systems are properly withholding PFML contributions.

On January 20, 2026, the state PFML Benefits Authority will review an actuarial analysis of the state PFML fund and vote on whether to uphold the May 1, 2026 benefits start date, or to postpone the start date up to 90 days.

Minnesota

Paid Family and Medical Leave Program Goes Live

Minnesota’s Paid Family and Medical Leave (PFML) program began January 1, 2026, providing eligible employees with up to 12 weeks of paid medical leave and up to 12 weeks of paid family leave, with a combined maximum of 20 weeks in a benefit year. Covered reasons include an employee’s own serious health condition, caregiving for a family member (defined broadly to include chosen family), bonding with a new child, qualifying military family reasons, and safety leave related to domestic violence, sexual assault, or stalking. Benefits are paid on a sliding scale, with a maximum weekly benefit of $1,423 in 2026, and eligibility is based on meeting the state earnings threshold in the prior four completed quarters (currently about $3,900).

Employers with Minnesota employees were required to post the PFML workplace poster and provide individual employee notices by December 1, 2025, with acknowledgment of receipt. Covered employers must also provide the same notice to new hires within 30 days of hire.

Payroll deductions began January 1, 2026, with first premium payments due to the state by April 30, 2026. Certain small employers (generally those with 30 or fewer employees and an average employee wage of less than 150% of the statewide average weekly wage, or $27,745.88 or less) may qualify for reduced premiums.

As with Delaware, employees who welcomed a new child in 2025 may be eligible for paid bonding in 2026, even if they exhausted all FMLA and employer-provided leave available to them, provided they’re within one year of the child’s birth or placement.

New Hampshire

Unpaid Childbirth-Related Leave

Beginning January 1, 2026, New Hampshire employers with 20 or more employees must provide up to 25 hours of unpaid leave within the first year after a child’s birth or adoption for childbirth or postpartum care and infant medical appointments. Employees may substitute accrued paid leave, employers may require reasonable notice, and employees are entitled to reinstatement. If both parents work for the same employer, they are limited to a combined total of 25 hours of leave.

New York

NYC Adds Requirements for Paid Prenatal Leave

New York State began requiring employers to provide 20 hours of paid prenatal leave in January 2025. Effective July 2, 2025, New York City imposed additional compliance requirements on employers with employees working in NYC. Covered employers must maintain and distribute a written prenatal leave policy upon hire, within 14 days of any changes, and upon request; post and provide an updated Notice of Employee Rights with proof of receipt; and include prenatal leave balances on pay statements (or provide a separate written notice) when prenatal leave is used. Employers may need to coordinate with their payroll providers to ensure pay-stub disclosures are compliant.

Rhode Island

TCI Benefits Increased and Expanded

Effective January 1, 2026, Rhode Island’s Temporary Caregiver Insurance (TCI) program provides eligible employees with up to eight weeks of paid leave for family caregiving and new child bonding reasons (up from seven weeks). In addition, employees may use TCI for their own recovery when serving as an organ or tissue donor, expanding access to TCI benefits beyond traditional caregiving and bonding scenarios.

Menopause Symptoms Added to Accommodation Law (Leave-Adjacent)

Rhode Island has expanded its pregnancy accommodation law to include menopause‑related conditions, including hot flashes and other vasomotor symptoms. Depending on the circumstances, accommodations may include leave, a modified schedule, additional breaks, or other reasonable adjustments, unless doing so would create an undue hardship.

Vermont

Expanded Unpaid, Job-Protected Leave Reasons

Beginning July 1, 2025, Vermont expanded its Parental and Family Leave Act to add new categories of unpaid, job-protected leave, including bereavement leave, safe leave related to domestic violence, sexual assault, or stalking, and leave for qualifying military exigencies. The law also broadens the definition of covered family members for caregiving purposes.

Eligible employees may take up to 12 weeks of unpaid leave in a 12-month period for these newly added reasons, as well as for existing covered purposes such as an employee’s own serious health condition, caregiving for a family member with a serious health condition, or parental leave.

Washington

PFML Job Protection Changes

Effective January 1, 2026, Washington State implemented several significant changes to job protection under its Paid Family and Medical Leave (PFML) program. The employee tenure requirement for job protection has been reduced from one year to 180 days, and job protection has been extended to employees at smaller employers—beginning with employers that have 25 or more employees working in Washington in 2026 (dropping to 15 employees in 2027 and 8 employees in 2028).

To reduce leave stacking, employers may now drain down Washington PFML job protection for employees who are concurrently taking FMLA and are eligible for Washington PFML paid benefits but do not apply for or receive them, provided the employer complies with the state’s notice requirements. This change is intended to prevent employees from preserving state PFML job protection while using only federal FMLA leave.

Employers must also give employees advance notice of the expiration of job protection at least five business days before the end date when the employee is taking continuous leave exceeding two workweeks or intermittent leave exceeding 14 typical workdays (combined). Tilt is prepared to manage these requirements for covered employers.

Finally, the minimum claim duration under Washington PFML has been reduced from eight hours to four hours, expanding access to benefits for shorter absences.

Greater Protections for Employees on PFML

Washington’s new Worker Adjustment and Retraining Notification (WARN) Act took effect on July 27, 2025. It requires employers with 50 or more Washington employees, not counting part-time workers, to provide 60 days’ notice of a mass layoff or business closing. The law also adds a new safeguard: employees out on Washington Paid Family and Medical Leave (PFML) generally may not be included in a mass layoff, except in limited cases such as natural disasters or unforeseen business circumstances. This means employers should track PFML status carefully during reduction-in-force planning.

Domestic Violence Leave Expanded to Hate Crime Victims

Effective January 1, 2026, Washington’s Domestic Violence Leave Act (DVLA) covers employees who are victims of hate crimes or whose family members are victims. Covered workers may take job-protected leave for legal, medical, counseling, or safety-related reasons, including relocation. The leave is generally unpaid, but employees may use accrued paid sick leave, and employers are prohibited from retaliation or discrimination.

About Tilt

Every leave is a defining moment in the employee experience. Tilt exists to transform these moments from sources of stress and risk into opportunities for trust, care, and connection. Through Leave Experience Management (LXM), we ensure leave is seamless, compliant, and empowering—so HR can lead with confidence and employees feel fully supported when it matters most.